But will it be a boring policy? Certainly not. This is the first policy after the rift between the Reserve Bank of India and government came to light and the tone and measures will be the first sign of who is ceding ground.

A downward revision in inflation and GDP

In its previous policy, inflation forecast was revised down. The reported trajectory of inflation has been benign with the latest CPI print for October coming at 3.31 percent driven by low food prices, although core inflation remains stubborn at 6.1 percent. With soft outlook for most commodities, albeit expectations of crude firming up due to OPEC meet on December 6, we expect RBI to lower its inflation forecast.

Source: MOSPI

Growth has surprised on the downside with Q2 FY19 GDP growth coming at 7.1 percent as against RBI’s projection of 7.4 percent. With GDP in the second half staring at a much higher base and consumption expenditure slowing down, it would be interesting to see RBI’s growth forecast.

Will RBI revert to a ‘neutral’ stance?

Should there be a downward revision in both parameters, it would be of interest to watch if the committee drops its ‘hawkish’ tone. It might adopt a cautious approach and wait till core inflation softens.

A revert to the neutral tone and lower growth outlook would raise expectations of a rate cut. However, given that the government has already overshot its fiscal deficit target in the first seven months of FY19 and collections from the Goods & Service Tax and disinvestment receipts short of target, a likely fiscal slippage will have a bearing on this decision.

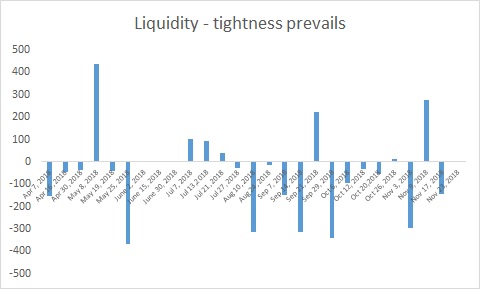

Liquidity support

The clamour for greater liquidity in light of the IL&FS fiasco and consequent risk aversion is likely to be addressed. Despite open market operations to the tune of Rs 1,37,000 crore so far and Rs 40,000 crore in December, systemic liquidity remains tight.

Source: RBI

While a cut in the cash reserve ratio is an option, it is unlikely since the liquidity issue pertains more to certain segments. Any intervention in the forex market (buying dollar and releasing rupee) can ease liquidity, but may not be deployed right away unless rupee strengthens significantly. Hence, it will be of interest to see how RBI addresses this concern for non-banking finance companies (NBFC)?

Through a series of announcements in the past couple of months, RBI has tried to ease flow of liquidity to the NBFC sector, further systemic liquidity support should pacify the government.

Loan restructuring for MSMEs?Hit hard by demonetisation and GST implementation, there has been a growing clamour to offer special dispensation to micro, small and medium enterprises (MSME) with loans up to Rs 25 crore. A restructuring scheme for this sector should go a long way in arriving at a truce between RBI and the government