Non-banking financial company IndoStar Capital Finance Ltd. will launch its Rs 1,844 crore initial public offering today, as private equity fund Everstone Group eyes a partial exit.

What’s On Offer

- The IPO includes a fresh issue of Rs 700 crore and an offer for sale by existing investors to the tune of of Rs 1,144 crore.

- The price band has been fixed at Rs 570-572 apiece.

- At the upper end of the price band, it will command a valuation of Rs 5,213 crore, according to BloombergQuint’s calculations.

- Funds raised through the fresh issue will be used to augment the company’s capital base.

- Promoter IndoStar Capital is looking to sell stake worth Rs 1,058 crore via the offer for sale while other selling shareholders are looking to sell stake worth Rs 85.3 crore.

- Post the offer, promoter shareholding will fall to 58.95 percent from from 91.5 percent currently. The rest will be held by public shareholders.

The lender, which started its operations in 2011, is backed by Everstone Group which holds 51.24 percent stake in IndoStar Capital Finance’s promoter company IndoStar Capital. The NBFC provides financing to corporates and small and medium enterprises.

Business

- Corporate and SME lending constitute 79 and 21 percent of overall loan book, respectively.

- The lender is making efforts to diversify into new line of businesses, and has recently ventured into vehicle finance and housing finance products.

- Branch network expansion is expected to support loan book.

- To expand its retail lending portfolio of vehicle financing and home loans, IndoStar has increased branch network from seven in the financial year 2016-17 to 43 as on the quarter ended December. It added another 57 branches in the March quarter alone.

Business Segments

1. Corporate Lending

Started in 2011, the segment formed 76.8 percent of its credit exposure as of Dec 31, 2017. It had a 14.1 percent average portfolio yield in FY17 and a customer base of 36.

2. SME Finance

This business was started since 2015, and constitutes 22.7 percent of the credit exposure as of Dec 31, 2017. It had a 11.1 percent average portfolio yield in FY17 and a customer base of 861 across eight states in India.

3. Home Finance

Started in September 2017, this business vertical had a miniscule Rs 14.6 crore credit exposure as of Dec 31, 2017. The NBFC has 14 affordable housing branches.

4. Vehicle Finance

Started in November 2017, the segment has a Rs 14.3 crore credit exposure as of Dec 31, 2017 via 56 branches.

Financials

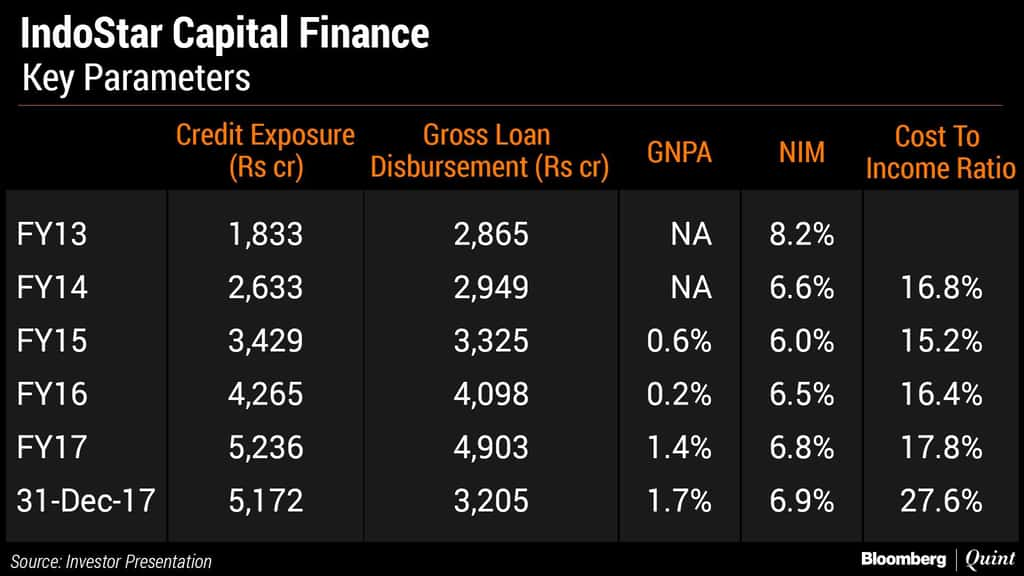

- The company’s business has experienced robust growth since the commencement of operations in 2011.

- Between the financial years 2013 and 2017, the total credit exposure and disbursements grew at 30 percent and 14.4 percent respectively.

- Net interest income grew at a compounded annual growth rate of 27.8 percent over FY13-FY17.

- Net profit has grown at 23.7 percent compounded in this period.

- Net interest margin stood at 6.9 percent as of 31 Dec 2017.

- Gross bad loans ratio has continued to tread higher over the years to 1.7 percent, but is still at a comfortable level.

- The return on equity is low and high capital adequacy ratio of approximately 31 percent suggests the balance sheet has been remained underutilised and the management is cautious on lending.

Peer Comparison

At the upper price band, IndoStar Capital Finance is valued at 1.9 times its book value on a post dilution basis. That is lower than SME lenders like Shriram City Union, Capital First, MAS Financial and real estate lenders like Piramal Enterprises. These companies are, however, not directly comparable as their portfolio and lending profiles differ.

Most brokerages, in their pre-IPO notes, said valuations are reasonable. Capital First, Shriram City Union Finance and MAS Financial Services trade at 2.6, 3.0 and 4.5 times their book values while corporate/real estate lender Piramal Enterprises trades at 2.9 times book value.

Brokerages’ Take

Aditya Birla Capital

- Recommends ‘Subscribe’

- Valuations are reasonable for the company having strong return on assets, adequate capital, strong management pedigree and is expected to deliver steady earnings growth.

Angel Broking

- Recommends ‘Subscribe’

- The strong sponsorship of Everstone and other shareholders, along with a well-capitalised balance sheet and an experience and focused management provide an excellent base for the next leg of growth.

IIFL Wealth Management

- Recommends ‘Subscribe’

- Valuations seem reasonable and leaves scope for re‐rating if strategic execution stays on course.

- As balance sheet gearing improves, return on equity will rise to respectable levels.

Hem Securities

- Recommends ‘Subscribe’

- Company looks like an attractive investment option considering its healthy financial performance and strong expansion plan.

Antique Broking

- Recommends ‘Avoid’

- Given that building a retail business is a slow process, more so in times of hyper competition, IndoStar will predominantly remain a wholesale lending NBFC for the next few quarters.

- The only silver lining in the IPO is the reasonable valuation.

ICICI Direct

- Recommends ‘Avoid’

- A major proportion of the wholesale portfolio has high real estate exposure, which is a negative.

Choice Broking

- Recommends ‘Avoid’

- Valuation of 1.9x book value may look cheap compared to well managed NBFCs, but the lender is presently a corporate lender and does not have presence in retail business and does not have experience in retail credit.

source:-.bloombergquint