The discounted cash flow (DCF) model is one of the most comprehensive valuation methods for estimating a company’s worth. Valuation determines a company’s current value by analyzing financial forecasts of its profits, typically through dividends or cash flows. Another useful valuation method is the discounted dividend model (DDM). Both DCF and DDM focus on understanding present value by projecting future earnings.

“Within a company, well-informed valuation enables managers to make wiser decisions regarding capital budgeting and strategic planning,” says Harvard Business School Professor Suraj Srinivasan in the online course Strategic Financial Analysis. “Outside the company, investors need to measure value to assess the risks and returns of their investments with greater confidence.”

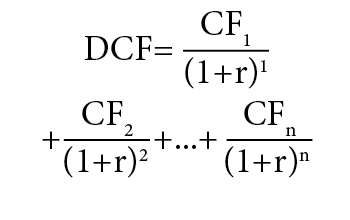

What exactly is discounted cash flow, or DCF? The discounted cash flow (DCF) model estimates a company’s intrinsic equity value by discounting projected future free cash flows to equity (FCF ͤ) using the time value of money principle.

To break that down:

Equity value: The sum of a company’s shares, which represent ownership by shareholders. Present value: The current value of an expected future financial return, usually a sum of money; it’s what your future money would be worth today

Free cash flow to equity (FCF ͤ): Funds available to shareholders, regardless of whether they’re distributed; this differs from dividends, which a company must return to its shareholders

Time value of money: The principle that a sum today is worth more than in the future due to its potential earning capacity

“A DCF analysis is useful when investing money now and expecting some rewards in the future,” Srinivasan says in Strategic Financial Analysis. “A DCF analysis finds the intrinsic value of a business, which is the present value of the free cash flow the company is expected to pay its shareholders in the future. It could be a good investment opportunity if the intrinsic value is higher than the current price. How Does Discounted Cash Flow (DCF) Work?